New signs of life for NFTs

Data shows new participants minting onchain and new use cases.

gm!

Don’t call it a comeback: although many have been quick to write off NFTs, the numbers tell a different story. Variant’s resident data scientist Jack Gorman (aka J.Hackworth) has uncovered data showing NFT interest has actually grown this year, and is primed for broader adoption. The rise of Ethereum layer 2s like Optimism, Base, and Zorachain is a big reason why.

Elsewhere, Mason Nystrom explains why humans will soon be using AI bots as an entrypoint into the crypto economy, and Alana Levin makes the case for putting more apps onchain.

Enjoy the arrival of the holiday szn, and while you’re thinking about presents, let us suggest you gift this newsletter to your fellow crypto builders and onchain pals.

—Dan Roberts, Editor in Chief

New Signs of Life for NFTs on Ethereum & L2s

To the outside world, NFTs are dead.

When you look at secondary-market sales data—the most commonly cited metric—it's hard to argue. Since the NFT market peak in January 2022, secondary trading volume on Ethereum has fallen by ~90%, and the number of distinct addresses buying an NFT on secondary platforms has fallen by ~82%. September 2023 saw the lowest NFT trading volume and number of buyers on Ethereum since June 2021.

But the secondary market (which has been picking up in recent weeks) only paints a partial picture. When you look elsewhere, there are new signs of life for NFTs.

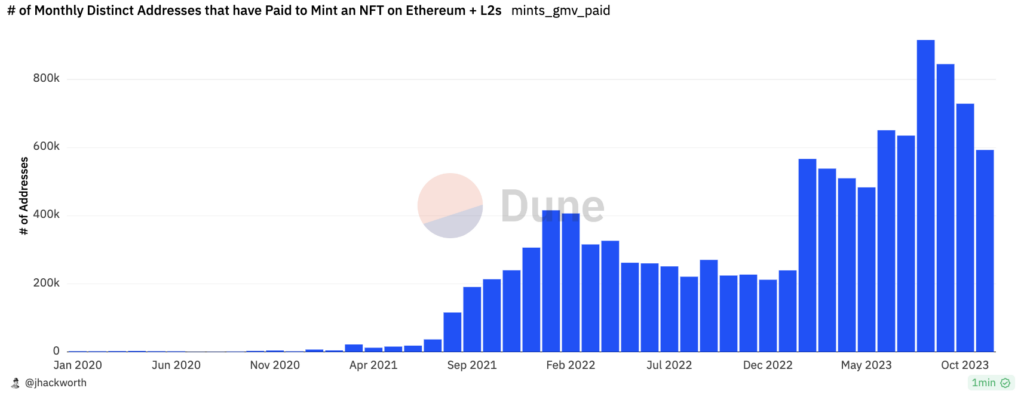

One encouraging indicator of NFT adoption is the growth in both creation and collection across Ethereum plus layer-2 solutions such as Base, Zora, and Optimism. For collecting, the number of distinct addresses minting paid NFTs over time has continually grown, suggesting there are new participants minting onchain.

The growth in collecting activity has been accompanied by a rise in new NFT contracts on chains like Zora and Base, driven by an array of creator tools that make it easier to create NFTs.

While there is certainly some spam and airdrop farming in these numbers, these stats should still be encouraging.

One possible explanation for the growth in distinct addresses and new contracts is a simple Occam's Razor view: As more projects, use cases, and art are being created, more cryptonatives are engaging in NFTs. And by lowering the overall financial costs of NFTs, more non-cryptonatives will join in the coming waves.

We may also be witnessing a shift in the perception and use cases for NFTs. In the past, rarity, exclusivity, and power-user trading were defining factors of the NFT market, making it harder to onboard more users to crypto. Now, the proliferation of NFTs in various formats and use cases beyond high-end collectibles presents a new opportunity to engage users and promote widespread adoption…

Read the rest of the post on our site. (We can’t fit the entire post in this email because of all the great charts—make sure to click through!)

Read this next

More fresh writing from the Variant team

Mason Nystrom: Crypto AI Agents: The First-Class Citizens of Onchain Economies

As more applications and protocols leverage AI agents, humans will use them as a conduit for accessing the crypto economy.

Alana Levin: What Onchain Apps Enable

When it comes to onchain apps, the question shouldn’t be whether blockchains are necessary but rather whether they’re helpful.

Li Jin: Love vs. Fame: A Framework for Social Applications

Social apps fall on a spectrum: love products are about deepening connections; fame products prioritize discovering new content from creators.

Thinking in public

We welcome your replies on Twitter and Warpcast. Click images to view on Twitter/X.

Jesse wants to uncomplicate how we think about app rollups:

Li views Spotify Wrapped as an example of where web3 can borrow from web2

Jack looked into what’s driving the growth in stablecoin supply

See you next issue. And if you read this in your inbox via Substack, remember you can also read on Mirror, where you can collect this issue as an NFT.

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Variant. While taken from sources believed to be reliable, Variant has not independently verified such information. Variant makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post reflects the current opinions of the authors and is not made on behalf of Variant or its Clients and does not necessarily reflect the opinions of Variant, its General Partners, its affiliates, advisors or individuals associated with Variant. The opinions reflected herein are subject to change without being updated. Variant is an investor in Zora.